Tokyo and Sydney rose while Hong Kong, Shanghai and Bangkok slid following a rise in U.S. futures Monday amid oil’s decline

Shares were mixed in Asia on Monday

after China's central bank cut a key interest rate and Japan reported its

economy expanded at a faster pace in the last quarter.

Tokyo and Sydney advanced while

Hong Kong, Shanghai and Bangkok fell. U.S. futures edged higher Monday while

oil prices declined.

The People's Bank of China cut

its rate on a one-year loan to 2.75% from 2.85% and injected an extra 400

billion yuan ($60 billion) in lending markets after government data showed July

factory output and retail sales weakened.

Beijing is aiming to shore up

sagging economic growth at a politically sensitive time when President Xi

Jinping is believed to be trying to extend his hold on power.

The ruling Communist Party

effectively acknowledged last month

itcan't hit this year's official 5.5% growth target after anti-virus curbs

disrupted trade, manufacturing and consumer spending. A crackdown on corporate

debt has caused activity in the vast real estate industry to plunge.

Thai recovery

Meanwhile, Japan reported its

economy expanded at a 2.2% rate in April-June from a year earlier, as

consumerspending rebounded with the lifting of COVID-19 restrictions.

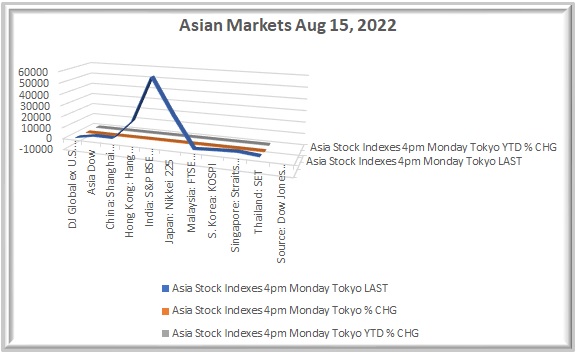

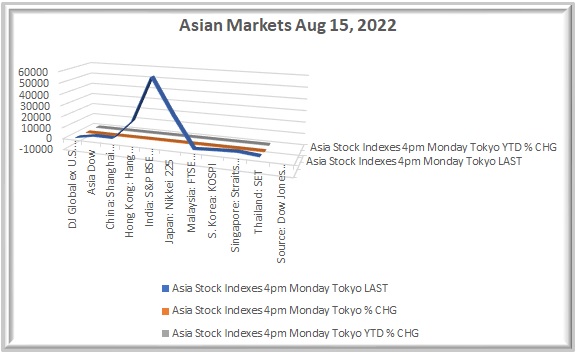

Tokyo's Nikkei 225 index added 1%

to 28,830.90 and the S&P/ASX 200 in Sydney climbed 0.4% to 7,061.81. The

Shanghai Composite index edged 0.1% lower to 3,274.19, while Hong Kong's Hang

Seng index gave up 0.2% to 20,135.75.

South Korean markets were closed

for a holiday.

Bangkok's SET index edged 0.1%

lower. The Thai government reported the economy expanded at a 0.7% quarterly

pace in April-June, slowing from 1.1% growth in the first quarter of the year.

Tourism has rebounded after two

years of tight controls to fight COVID-19, but only to about a quarter of the

pre-pandemic level.

Broad rally

"The outlook for the rest of

the year will depend in large part on how quickly tourism recovers,"

Gareth Leather of Capital Economics said in a commentary.

On Friday, Wall

Street capped a choppy week of trading with a broad rally, as the S&P

500 notched its fourth consecutive weekly gain.

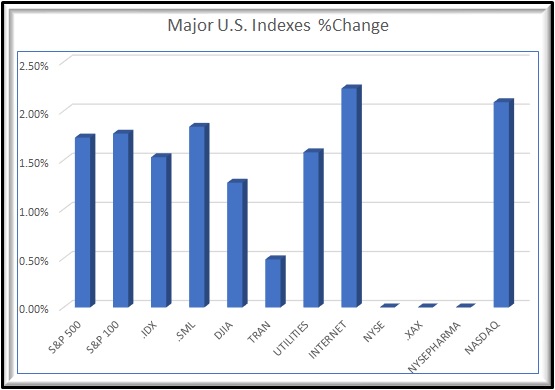

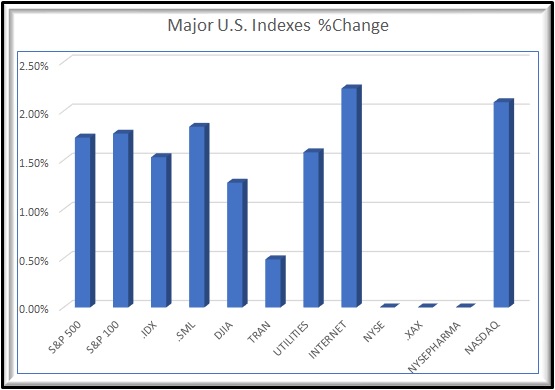

The benchmark index closed 1.7%

higher, at 4,280.15, for a 3.3% weekly gain. The S&P 500 hadn't posted such

a good stretch since November.

The Dow Jones Industrial Average

rose 1.3% to 33,761.05, while the Nasdaq gained 2.1% to 13,047.19. The Russell

2000 index of smaller companies added 2.1% to 2,016.62.

Major indexes got a big bump on

Wednesday after a report showed that inflation cooled more than expected last

month. Another report on Thursday showed inflation at the wholesale level also

slowed more than expected.

Aggressive rate hikes

They raised hopes among investors

that inflation may be close to a peak and that the Federal Reserve could ease

off on interest rate hikes, its main tool for fighting inflation.

The aggressive

pace of rate hikes has investors worried that the Fed could steer the

economy into a recession.

The yield on the 10-year Treasury

fell to 2.84% from 2.88% late Thursday. It remains below the two-year yield.

inversion of the expectation that borrowing money for a longer period

should cost more than a shorter period. When investors demand a higher return

for a short term like the 2-year than a longer one like 10 years, it's viewed

by some investors as a reliable signal of a pending recession. The economy has

contracted for two consecutive quarters.

This week, the Commerce Department

releases its retail sales report for July and retail giant Walmart reports its

latest financial results.

Home sales outlook

Investors can also assess the

health of the housing market when they get a report on home sales for July and

the latest earnings from Home Depot.

In other trading Monday, U.S.

oil shed 82 cents to $91.27 per barrel in electronic trading on the New

York Mercantile Exchange. It lost $2.25 per barrel on Friday.

Brent crude oil, the basis for

pricing for international trading, gave up 83 cents to $97.32 per barrel.

The U.S. dollar slipped to 133.28

Japanese yen from 133.43 yen. The euro weakened to $1.0249 from $1.0261.

Also Read:

Dems'

climate, energy, tax bill clears initial Senate hurdle

UN

chief calls for quick halt to military activities near nuclear plants

SoftBank

to book $34 billion gain by cutting Alibaba stake

Biden

signs chips bill to boost semiconductor production, compete with China

font-family:"Arial",sans-serif;mso-fareast-font-family:Calibri;mso-fareast-theme-font:

minor-latin;mso-bidi-theme-font:minor-bidi;mso-ansi-language:EN-US;mso-fareast-language:

EN-US;mso-bidi-language:AR-SA">

Twomore ships carrying grain leave from Ukraine, Turkey says