What are implications of looming US debt crisis?

World is anxiously watching ongoing political bickerings in Washington as global economy teeters on brink of recession

By News Desk

Published - May 16, 2023, 03:05 PM ET

Last Updated - Jul 18, 2023, 03:25 PM EDT

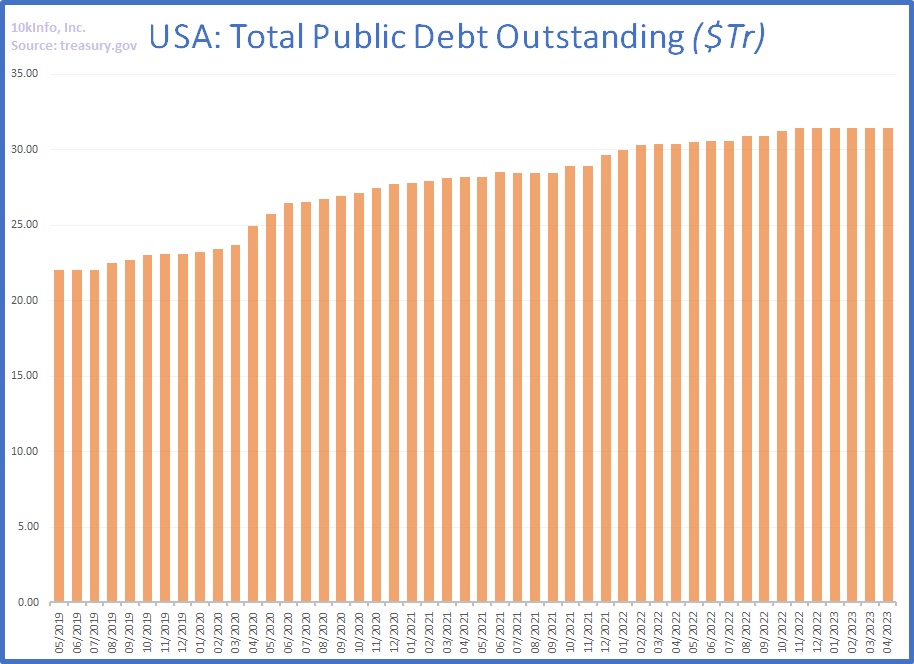

President Joe Biden’s administration is once again facing a critical challenge as it tries to tackle the rising national debt. The looming US default is already roiling the market with uncertainty. It’s not good news for a world economy teetering on the brink of a global recession.

Let us look at what the impending crisis is and what President Joe Biden’s efforts to avert a crisis are. The crisis will have implications for the US and the world economy. Remember that the global economy is still reeling under the ongoing Russia-Ukraine war that broke out even before the world could recover from the crippling effects of the COVID-19 pandemic and the subsequent supply chain disruption.