US employers added a robust 339,000 jobs in May in sign of a still-healthy labor market despite Fed rate hikes

WASHINGTON AP" target="_self">(AP) — The nation’s employers stepped up their hiring in May, adding a robust 339,000 jobs, well above expectations and evidence of enduring strength in an economy that the Federal Reserve is desperately trying to cool.

Friday's report from the government reflected the job market's resilience after more than a year of rapid interest rate increases by the Fed. Many industries, from construction to restaurants to health care, are still adding jobs to keep up with consumer demand and restore their workforces to pre-pandemic levels.

Yet there were some mixed messages in the jobs figures, which also showed that the unemployment rate rose to 3.7%, from a five-decade low of 3.4% in April. The government compiles the unemployment data with a different survey than the one used to calculate job gains. The two surveys can sometimes conflict.

The length of the average work week also declined, and wage growth cooled, resulting in a jobs report that economists said painted an unusually complicated picture of the employment market. Still, the overall picture was an encouraging one.

“Job growth remains robust in what is undeniably a historically tight labor market,” said Joe Brusuelas, chief economist at consulting firm RSM. “As long as the economy continues to produce above 200,000 jobs per month this economy simply is not going to slip into recession.”

In Friday’s report, the government sharply revised up its estimate of job growth in March and April by an additional 93,000 jobs, underscoring the labor market’s durability.

Slowdown in wages

Average hourly pay rose 11 cents to $33.44, up 4.3% from a year ago. Wages continue to grow faster than the 3% annual pace before the pandemic but are down from a nearly 6% rate last year.

Even with the huge job gain, the slowdown in wages and shorter work week are likely enough to keep the Fed from raising its key interest rate at its next meeting later this month, economists said. Having imposed 10 straight rate hikes since March 2022, the Fed is widely expected to skip a rate increase when it meets later this month, though it may resume its increases after that.

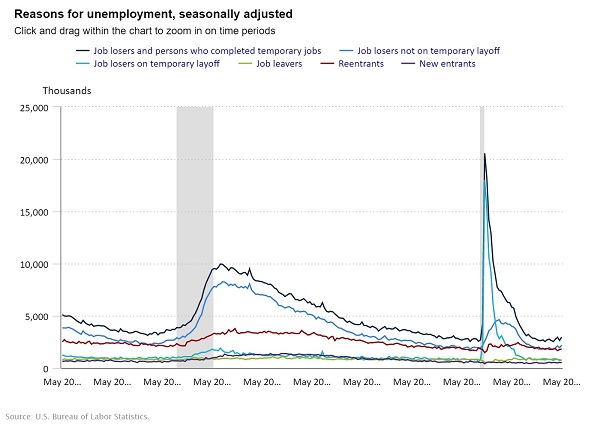

Last months' increase in the unemployment rate partly reflected higher layoffs, suggesting that not all those who lost jobs in recent cuts by tech companies, banks and media companies have found new work.

The hiring data, though, is typically considered more reliable over time because it is based on a larger survey of companies. The unemployment rate is derived from a smaller survey of households.

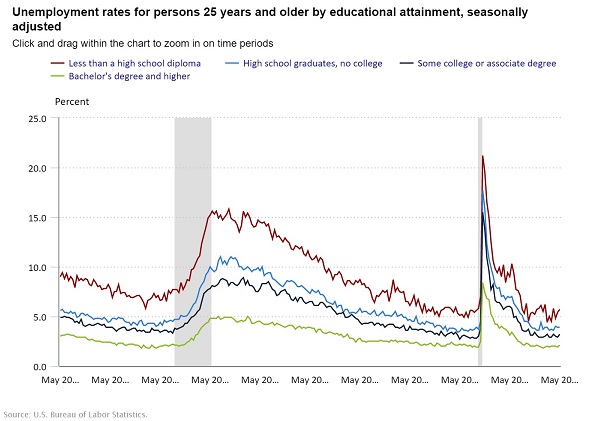

Drew Matus, chief economist at MetLife Investment Management, cautioned that underneath the big headline job gain, there were signs that companies were turning more cautious about hiring. He noted that joblessness rose last month for teenagers, the disabled and people with less education. That was a sign that companies were cutting workers with fewer skills and less experience.

“Before it was a rising tide lifts all boats, and now it seems like the boats have gotten smaller and firms are deciding who gets to sit in them,” Matus said.

Commercial construction

In May, construction companies added 25,000 jobs, mostly in commercial construction and engineering. Health care providers gained 75,000 jobs. And in professional and business services, a category that includes white-collar jobs such as accountants, engineers, and architects, 64,000 positions were added.

Chair Jerome Powell and other Fed officials have made clear that they regard strong hiring as likely to keep inflation persistently high because employers tend to raise pay in a tight job market. Many of these companies then pass on their higher wage costs to customers in the form of higher prices.

And consumers are showing signs of straining to keep up with higher prices. The proportion of Americans who are struggling to stay current on their credit card and auto loan debt rose in the first three months of this year, according to the Federal Reserve Bank of New York.

Fed officials are expected to forgo a rate increase at their June 13-14 meeting to allow time to assess how their previous rate hikes have affected the inflation pressures underlying the economy. Higher rates typically take time to affect growth and hiring. The Fed wants to avoid raising its key rate to the point where it would slow borrowing and spending so much as to cause a deep recession.

The U.S. economy as a whole has been gradually weakening. It grew at a lackluster 1.3% annual rate from January through March, after 2.6% annual growth from October through December and 3.2% from July through September.